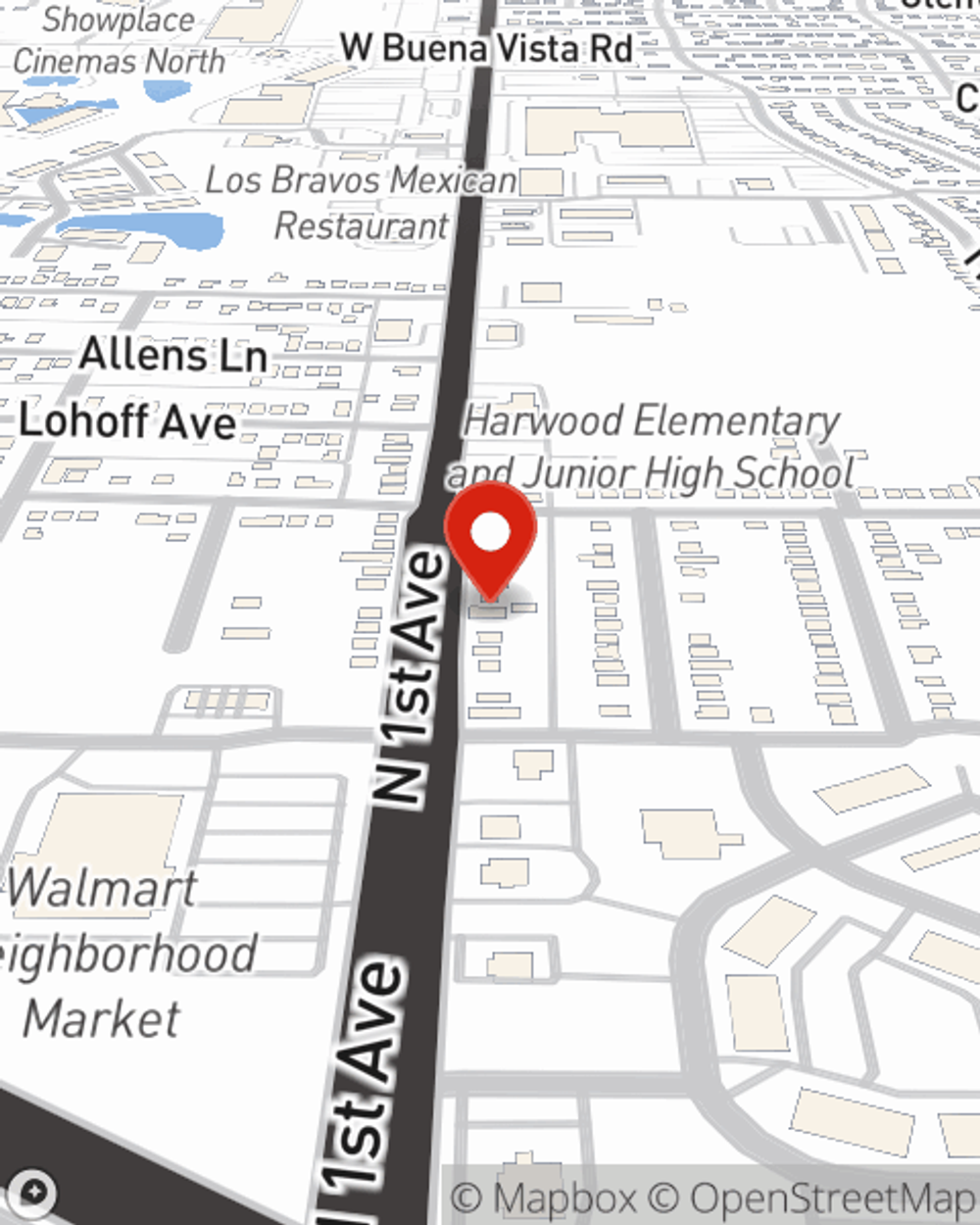

Business Insurance in and around Evansville

One of the top small business insurance companies in Evansville, and beyond.

Helping insure businesses can be the neighborly thing to do

Cost Effective Insurance For Your Business.

Do you feel overwhelmed when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Pam Lentz help you learn about quality business insurance.

One of the top small business insurance companies in Evansville, and beyond.

Helping insure businesses can be the neighborly thing to do

Protect Your Business With State Farm

That's because a small business policy from State Farm covers a wide range of concerns. Your coverage can include a business owners policy that provides for loss of income (for up to 12 months) in the event your business is shut down. It not only protects your salary, but also helps with regular payroll overhead. You can also include liability, which is crucial coverage protecting you in the event of a claim or judgment against you by a third party.

Call or email the excellent team at agent Pam Lentz's office to learn more about the options that may be right for you and your small business.

Simple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Pam Lentz

State Farm® Insurance AgentSimple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.